By Jery Payne

You’re ready to brave the groans from your peers. You’re ready to brave the dark looks from the state patrol’s liaison. You are ready to create a new special license plate. You’re ready because, darn it, this is such a good cause!

You’re ready to brave the groans from your peers. You’re ready to brave the dark looks from the state patrol’s liaison. You are ready to create a new special license plate. You’re ready because, darn it, this is such a good cause!

But are you sure you’re ready? Before submitting your bill request, ask yourself the following questions:

Is the group who wants the plate a business? The law prohibits issuing a special license plate to “any business entity conducted for profit.” (See section 42-3-207, C.R.S.) The General Assembly probably will not beat the drum for a business on account of your little plate. The Department of Revenue requires each group to prove nonprofit status with a letter from the Internal Revenue Service or the Colorado Secretary of State, (see 1 CCR 204-10, Rule 16 (2.2)(A)(2)) which must be submitted yearly (see 1 CCR 204-10, Rule 16 (3.5)).

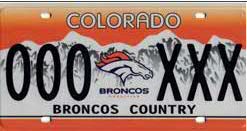

Now, I know what some of you are thinking: “Didn’t I see a Broncos plate?  I am pretty sure they have made a few bucks over the years.” Technically, the Broncos football team didn’t establish the plate; the Denver Broncos Charities established it. The Department of Revenue—also known as the tax collectors—may audit a group to ensure compliance (see 1 CCR 204-10, Rule 16 (3.10)). So make sure the group wanting the plate is not a business, even if they have to create a charity to do it.

I am pretty sure they have made a few bucks over the years.” Technically, the Broncos football team didn’t establish the plate; the Denver Broncos Charities established it. The Department of Revenue—also known as the tax collectors—may audit a group to ensure compliance (see 1 CCR 204-10, Rule 16 (3.10)). So make sure the group wanting the plate is not a business, even if they have to create a charity to do it.

Have at least 3,000 people committed to buy the special plate? If your group wants a group plate, they need to prove that 3,000 people will pay $50, cash on the barrel, to buy the plate within one year. (See section 42-3-207, C.R.S.) Traditionally, a special license plate costs an extra $50. You could set the fee at whatever you can get passed into law, but many people won’t like it if you set it lower than $50. Other groups may not like you undercutting the fee for their plates, and both the revenue and transportation folks may miss the money.

“Now, hold on,” you might be thinking. “Didn’t I see a medal of honor plate? I’m pretty sure there aren’t 3,000 medal of honor winners living in Colorado.” The law divides special license plates into two types: distinctive plates and group plates. A distinctive special license plate is “a special license plate that is issued to a person because such person has an immutable characteristic or special achievement honor.” (See section 42-1-102, C.R.S.) A special achievement does “not include a common achievement such as graduating from an institution of higher education.” (See id.) But it does include “honorable service in the armed forces of the United States.” (See id.) The 3,000 commitments rule does not apply to distinctive plates. (See 42-3-207, C.R.S.)

Technically, the paperwork showing the 3,000 commitments is due by March 1 of each year (see section 42-3-207, C.R.S.), but in practice this law is a bit like the pirates’ code in that it appears to be “more like a guideline, really.” Your peers enforce it. Bills usually die without the 3,000 commitments, but they don’t usually die for missing the deadline. Your results may vary. So if it is not a military, disabled, or other distinctive plate, make sure your group has 3,000 people signed up and try to get it done by March 1.

Has the plate design been blessed? Each special license plate must meet the design requirements of the Department of Revenue. Peace officers need to be able to read the plate number, and the state doesn’t want to be sued over special plates. A few years back, the state was sued because we were issuing a license plate using a copyrighted logo. Now the department won’t approve a logo unless the group owns it or the state has written permission to use it (see 1 CCR 204-10, Rule 16 (2.2)), so make sure the design has been approved.

Have you thought about whether to use the plate to raise money? Some plates merely beat the drum for a group, but some plates raise money for a group.

The Colorado constitution requires a “license, registration fee, or other charge with respect to the operation of any motor vehicle upon any public highway” to be used for “construction, maintenance, and supervision of the public highways.” (See section 18 of article X of the Constitution of the State of Colorado.) At first glance, this appears to forbid raising money with plates. However, there is an argument that this requirement doesn’t apply to special plates because the money isn’t really being collected to operate a motor vehicle on a public highway. In Thrifty Rent-A-Car v. Denver, the Colorado Court of Appeals ruled that this law did not apply to an airport fee paid for a car rental. (See Thrifty Rent-A-Car v. Denver, 833 P.2d 852 (Colo.App. 1992).) The fee was for cars rented at airports but not elsewhere. The court explained:

[T]he transaction fee imposed by the City and County of Denver is not used for “the operation of a motor vehicle.” Specifically, we agree with the trial court that the transaction fee was charged to Thrifty for operating a business through the airport. … the fees are based on access to the airport. If Thrifty receives only a few customers from the airport, then the required fee is minimal. Alternatively, if Thrifty receives many customers from Stapleton, it is assessed a larger transaction fee. (See id. at 856)

The court figured a fee for renting a car from an airport is different from a fee for using a car on the highway. The number of cars on the highway did not increase merely because more people paid the fee. Likewise, the number of cars on the road does not increase because more people buy a special plate rather than an old-fashioned plate. The fee is really for a fancy-schmancy license plate. Nevertheless, legal opinions differ, so this may be an issue if you decide to raise money for your group with a special license plate.

Another constitutional provision forbids giving money to private groups:

No appropriation shall be made for charitable, industrial, educational or benevolent purposes to any person, corporation or community not under the absolute control of the state, nor to any denominational or sectarian institution or association. (See section 34 of article V of the Constitution of the state of Colorado.)

This law may forbid the state from giving money to your group. Most groups avoid the problem by collecting the money for themselves. (For an example, see section 42-3-227 (3), C.R.S.) To use this strategy, your group must collect the money and issue a receipt. The state will merely confirm that the customer has paid the money to your group. This strategy avoids both constitutional issues, but it does have one setback: The group can collect the money only when the plate is issued.

Nevertheless, a couple of groups do have the state collect the money using a different strategy: Instead of the money going to the group, it is used for a government program that the group supports. An example is the plate helping shelter pets; the state collects a yearly plate fee that it uses to spay and neuter pets. (See section 42-3-234, C.R.S.) So if your group supports a specific government program, this strategy allows money to be collected yearly.

If all this is squared away, then you are ready to try your hand at passing a bill to create the special plate.

Editor’s note: For additional information regarding license plate laws see “An Update on Special License Plates,” posted September 10, 2015.