by Julie Pelegrin

Editor’s Note: Last September, LegiSource began a series of articles focusing on statutory construction. So far, we have posted two articles: “Introduction to Statutory Construction – the Plain Meaning Rule”and “What Do You Mean by That? Definitions in the Statutes”. This week’s article is the third in the series.

Even the most carefully drafted statute may have unnoticed and unintended ambiguities. When a statute refers to a single child, can it also apply to multiple children? If the statute only uses the pronoun “he” does it really only apply to men? If a statute gives a person seven days to file a notice, when do the seven days start, and do they include the weekend?

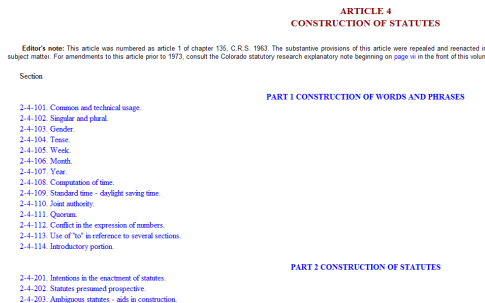

Anticipating these issues, the General Assembly long ago adopted part 1 of article 4 of title 2, C.R.S., “construction of words and phrases.” This part has several sections that clarify statutory meaning. In this article, we’ll look at the rules for interpreting the use of singular and plural, the use of gender, and statements of time.

Singular and plural: §2-4-102, C.R.S.

The singular includes the plural, and the plural includes the singular.

Generally, it’s good drafting practice to use the singular tense, e.g., referring to a child instead of children, a parent instead of parents, or a car or sign instead of cars and signs. But that doesn’t mean that the statute applies only to a single child, parent, car, or sign because the singular includes the plural. The Colorado Court of Appeals applied section 2-4-102, C.R.S., to hold that a separate adoption petition isn’t necessary for each of four children of the same deceased mother, even though the statute refers to preserving the anonymity of the adopted “child.” Another court found that a municipality that created conflicting messages between a traffic control signal and temporary stop signs waived its sovereign immunity, even though the statute referred to the waiver of immunity for failure to repair “a” traffic signal. A singular word includes the plural.

Gender: §2-4-103, C.R.S.

Every word importing the masculine gender only may extend to and be applied to females and things as well as males; every word importing the feminine gender only may extend to and be applied to males and things as well as females; and every word importing the neuter gender only may extend to and be applied to natural persons as well as things.

So, if a statute uses only the pronoun “he”, it also applies to women; if it uses only “she”, it also applies to men; and if it uses only “it”, it also applies to people. This rule only applies to statutes that can factually apply to both genders and to people as well as things. But, it’s good drafting practice to avoid using a gender-specific noun or pronoun unless the statute is really intended to apply only to a single gender.

Interpreting time: Sections 2-4-104 to 2-4-109, C.R.S.

There are several statutory sections to help us calculate time in the statutes. A word in the present tense includes the future tense (see 2-4-104, C.R.S.). The word “week” means any seven consecutive days, apparently including weekends (see 2-4-105, C.R.S.). The word “month” means a calendar month (see 2-4-106, C.R.S.). An early case interprets this section as meaning the period beginning on one day of a month and continuing until the corresponding day of the next month, if there is a corresponding day. If there isn’t, then the calendar month ends on the last day of the succeeding month – i.e., a calendar month from May 15 expires on June 15, but a calendar month beginning on May 31 expires on June 30. And the word “year” means a calendar year (see 2-4-107, C.R.S.). Recently, the Colorado court of appeals applied this section and section 2-4-108, C.R.S., (discussed below) and held that

a period of years ends on and includes the anniversary date in the concluding year, that is, the same month and day of the concluding year as the month and day from which the computation began.

Section 2-4-108, C.R.S., provides a few more helpful rules for computing time. First, in counting a period of days, the first day doesn’t count and the last day does. For example, a bill that passes without a safety clause generally takes effect on the 91st day after the General Assembly adjourns sine die. This year, the General Assembly adjourned on May 7. The ninety-one day period started counting on May 8, so this year several bills took effect on August 6, the 91st day after May 7.

But if the last day of a period falls on a Saturday, Sunday, or legal holiday, the deadline extends to include the next business day.

If a time period is expressed as a number of months, the period ends on the same numerical day in the last month as the numerical day on which the period started in the first month, unless there aren’t that many days in the last month, in which case it ends on the last day of the last month. A six-month period that begins on March 2 ends on September 2, but a six-month period that begins on March 31 ends on September 30, unless the last day in the period is a weekend or a holiday. In that case, the period ends for both examples on the next business day.

Finally, section 2-4-109, C.R.S., requires Colorado to operate on daylight savings time in accordance with federal law.

So we’re all clear on how to interpret singular, plural, gender, and time in the statutes. In the next article in this series on interpreting the statutes, we’ll learn the number of persons required for a public body to act, how to interpret the word “to” in reference to multiple sections, and just what is an “introductory portion.”